UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under § 240.14a-12 |

LUXFER HOLDINGS PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11. |

NOTICE OF 2022 ANNUAL GENERAL

2:00 p.m., BST Wednesday, June 8, 2022

Lumns Lane, Manchester, M27 8LN United Kingdom

|

| ||

DEAR LUXFER SHAREHOLDERS,

| I have the pleasure of enclosing the notice of Luxfer’s 2022 Annual General Meeting of Shareholders (“AGM” or the “Annual General Meeting”). The AGM will be held at the Luxfer MEL Technologies site, located at Lumns Lane, Manchester, M27 8LN, United Kingdom, on June 8, 2022, at 2:00 p.m. BST. The formal notice of the AGM is set out on page i of this document (the “Notice”). As a holder of ordinary shares, you may attend and/or vote at the AGM, or you may appoint another person as your proxy. To be valid, a form of proxy must be submitted in accordance with the instructions set out in the section entitled “Annual General Meeting Information” on page |

Board Chair | |

| Fiscal 2021 was a momentous year for Luxfer, as we continued to execute our strategy and fulfill our mission to create a safe, clean, and energy-efficient world by reducing the weight of the high-performance components used by our customers. Having recently assumed the role of Board Chair, I am grateful to be able to share some perspective about the Board’s efforts this past year, including successful leadership transitions and the advancement of our environmental, social, and governance (“ESG”) initiatives. Despite the ever-changing set of challenges posed by the COVID-19 pandemic, 2021 marked a year of great progress for Luxfer, and I am excited to work closely with my fellow Board members to build on that momentum to accelerate shareholder value creation. | ||

| Alok Maskara will step down from his role as Chief Executive Officer in May 2022, and Heather Harding, former Chief Financial Officer, retired in March 2022. In August 2021, David Landless, former Board Chair, gave notice of his intent to step down from the Board following the 2022 Annual General Meeting. These outstanding leaders significantly contributed to the success of the Company. During their tenure, they positioned Luxfer for future growth, focused our strategic initiatives, bolstered our balance sheet, and fostered a values-based culture with high-quality talent. On behalf of the entire organization, I want to thank Alok, Heather, and David for their years of dedication to Luxfer and for their role as valued mentors to so many colleagues. |

We are delighted to promote Andy Butcher to Chief Executive Officer and a member of Luxfer’s Board, effective May 6, 2022. Andy is a strategic, growth-oriented leader and brings over 30 years of experience with Luxfer. Likewise, Stephen Webster was promoted to Chief Financial Officer, effective March 1, 2022. For the past six years, Steve has been instrumental in the Company’s business and portfolio transformation, including the modernization of Luxfer’s control processes. As a testament to our succession planning and talent management processes, the Board is confident that, under Andy’s and Steve’s leadership, Luxfer will continue executing our strategic Transformation Plan to deliver growth and long-term shareholder value.

Throughout the year, the Board continued its oversight role in advancing the Company’s ESG initiatives and, in turn, promoting a long-term sustainable business. While there is more work to do, we made progress towards achieving our 2025 Environmental Goals by investing in new projects to reduce our carbon footprint and increase operational efficiencies. As a key priority for the Board and our management teams, our ESG practices will continue to serve as a catalyst for value creation, risk management, and stakeholder engagement. We look forward to providing an update on our progress in our upcoming ESG Report to be published in late 2022.

On behalf of the entire Luxfer team, I would like to thank you for your continued trust and support through this pivotal phase in our history. We are excited and optimistic about our future and look forward to sharing our journey with you. The Board considers all resolutions set out in the Notice to be in the best interest of the Company and its shareholders and believes that such resolutions are likely to contribute to the Company’s success. Accordingly, the Board recommends that you vote in favor of each resolution being put before the shareholders at the AGM in the same way as the Directors intend to vote their own shareholdings.

Thank you for being a Luxfer shareholder.

Sincerely,

Patrick Mullen Board Chair April 27, 2022 |  |

DEAR LUXFER SHAREHOLDERS,

After another year of successfully navigating the global pandemic and the challenging business landscape, Luxfer demonstrated resilience in 2021. The key to our success was our people and their commitment to executing our business plan. Throughout the year, the Luxfer team continued to leverage our technical expertise, operational excellence, and financial discipline to deliver strong business results in 2021. Our customer-first approach during these turbulent times and the performance this past year reinforces my confidence about Luxfer’s future.

Despite the economic difficulties of 2021, we continually upheld commitments to our customers by focusing on deliveries, collaboration, and innovation. We acquired Structural Composites Industries in March 2021, which is providing synergistic benefits, better serving our customers with increased product choice and enhanced capability, especially in the alternative fuels market. After working with Department of Defense research staff, our Elektron segment launched the new Unitized Group Ration - Express (UGR-E) offering in our Meals Ready to Eat product line, while also employing our expertise in zirconium materials engineering to develop new products in the medical and electronics end markets. With our continued focus on innovation, Luxfer is well positioned to enhance partnerships with our current customers and establish bonds with new prospects in 2022 and beyond.

Our focus on execution helped drive strong financial results in 2021, including a 15.2% sales increase, 7.5% organic revenue expansion, and 17.6% EBITDA growth.1 We returned approximately $20 million to shareholders through dividends and share buybacks throughout the year. Our strategic Transformation Plan continues to deliver returns. Over the past several years of work under the Plan, we have generated long-term shareholder value by simplifying the Company’s structure, producing significant and sustainable cost savings, launching multiple growth initiatives, and instilling a high-performance growth culture. With the major undertakings of this Plan complete, in early 2022, we introduced adjusted earnings per share guidance of $2.00 or more by 2025, representing our confidence in the outlook for the Company. |

Chief Executive Officer Designate |

Our Transformation Plan progress through 2021, enabled by the hard work of Luxfer’s team, has paved the way for a future more focused on growth. I am proud of the momentum established by our commercial and innovation initiatives, and I am confident that these tools, our strategy, and talented team give us the capability we need to accelerate profitable growth and, in turn, shareholder value. In this next phase of Luxfer’s history, we will continue driving Luxfer forward in the only way we know how – by living our values, doing business with integrity, and always putting our customers first.

I am excited to be designated the next CEO of Luxfer, and I look forward to serving as a member of our Board of Directors. Having joined the Company over thirty years ago as a young engineer, I have been proud to be part of our evolution into a business that is dedicated to helping create a safe, clean, and energy-efficient world. Entering 2022, I am confident that we have the strategy, talent, and ambition to thrive in the current dynamic business environment. I look forward to leading our more than 1,300 employees in delivering results for the long-term benefit of our shareholders, customers, employees, and the global community.

Thank you for being a Luxfer shareholder.

Sincerely,

Andy Butcher Chief Executive Officer Designate April 27, 2022 |  |

1 Organic revenue growth and EBITDA are non- GAAP measures. For a reconciliation and explanation of these non-GAAP measures, see Appendix A.

NOTICE OF 2022 ANNUAL GENERAL

MEETING OF SHAREHOLDERS

| Date & Time |  | Location | ||

Wednesday, June 8th, 2022 2:00 p.m., BST | Luxfer MEL Technologies Lumns Lane, Manchester, M27 8LN, United Kingdom | ||||

| Ordinary Resolutions |

| 1. To elect Andy Butcher as a Director of the Company. |

| 2. To elect Patrick Mullen as a Director of the Company. |

| 3. To re-elect Clive Snowdon as a Director of the Company. |

| 4. To re-elect Richard Hipple as a Director of the Company. |

| 5. To re-elect Lisa Trimberger as a Director of the Company. |

| 6. To approve, by non-binding advisory vote, the Directors’ Remuneration Report for the year ended December 31, 2021 (the “Directors’ Remuneration Report”). |

| 7. To approve, by non-binding advisory vote, the compensation of the Company’s Named Executive Officers (the “Named Executive Officers”). |

| 8. To approve, by non-binding advisory vote, the frequency of “Say-On-Pay” votes. |

| 9. To ratify the re-appointment of PricewaterhouseCoopers LLP as the independent auditor (the “Independent Auditor”) of the Company until conclusion of the 2023 Annual General Meeting. |

| 10. To authorize the Audit Committee of the Board of Directors to set the Independent Auditor’s remuneration. |

| 11. To approve the Company’s Amended and Restated Long-Term Umbrella Incentive Plan. |

| 12. To approve the Company’s Amended and Restated Non-Executive Directors Equity Incentive Plan. |

| Special Resolutions |

| 13. Subject to (i) the consent of the holders of the deferred shares of £0.0001 each in the capital of the Company (the “Deferred Shares”) being duly obtained in accordance with Article 7 of the Company’s Articles of Association and (ii) the confirmation of the court, to approve the reduction of the issued share capital of the Company by cancelling and extinguishing all of the issued Deferred Shares, each of which is fully paid up, and, of the amount by which the share capital is so reduced, an aggregate sum of £76,180.60 be repaid to the holders of Deferred Shares (pro rata to their holdings of Deferred Shares) and the remaining amount be credited to the Company’s reserves. |

| 14. Subject to Resolution 13 being duly passed as a special resolution and the capital reduction described therein taking effect, to approve amendment of the Company’s Articles of Association by deleting Article 5.2 and the definition of “Deferred Shares” set forth in Article 2.1. |

Please review the Proxy Statement accompanying this Notice for more complete information regarding the Annual General Meeting, as well as the full text of each resolution to be proposed at the Annual General Meeting. Resolutions 1 through 12 are proposed as ordinary resolutions, and Resolutions 13 and 14 are proposed as special resolutions. Further information on each resolution is provided on pages 1213 through 3233 of the Proxy Statement.

BY ORDER OF THE BOARD OF DIRECTORS:

Megan E. Glise

Company Secretary

Milwaukee, Wisconsin, U.S.

April 27, 2022

i

TABLE OF CONTENTS

| 1 |  |

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on Wednesday, June 8, 2022

ANNUAL GENERAL MEETING INFORMATION

| GENERAL |

Notice is hereby given that the Annual General Meeting of LUXFER HOLDINGS PLC (the “Company” or "Luxfer"), a public limited company incorporated in England and Wales under Company No. 03690830, will be held on Wednesday, June 8, 2022, at 2:00 p.m. BST. at the Luxfer MEL Technologies site, located at Lumns Lane, Manchester, M27 8LN, United Kingdom (with entrance on Rake Lane).

| ORDINARY RESOLUTIONS |

Each Luxfer ordinary share is entitled to one vote on each matter properly brought before the Annual General Meeting. Resolutions 1 through 12 will be proposed as ordinary resolutions, which means, assuming a quorum is present, each of Resolutions 1 through 12 will be approved if a simple majority of the votes cast are cast in favor thereof. With respect to the non-binding, advisory votes on Resolutions 6, 7, and 8 regarding the approval of the Directors’ Remuneration Report, the compensation of our Named Executive Officers, and the frequency of “Say-On-Pay” votes, the result of these votes will not require the Board of Directors or any committee thereof to take any action. However, our Board values the opinions of our shareholders as expressed through their advisory votes and will carefully consider the outcome. Additionally, Luxfer shareholders may be asked to consider and act on other business as may properly come before the Annual General Meeting or any adjournment thereof. If you are in any doubt as to what action you should take, please seek your own financial advice from your stockbroker or other independent advisor.

| SPECIAL RESOLUTIONS |

Each Luxfer ordinary share is entitled to one vote on each matter properly brought before the Annual General Meeting. Resolutions 13 and 14 will be proposed as special resolutions. Assuming a quorum is present, each of Resolutions 13 and 14 will be approved if at least 75% of the total voting rights of members entitled to vote, and who cast their vote in person or by proxy, are cast in favor thereof.

| PROXY VOTING |

In accordance with the Companies Act 2006 and the Company's Articles of Association, a shareholder of record is entitled to appoint another person as their proxy to exercise all or any of their rights to attend, speak, and vote at the Annual General Meeting and to appoint more than one proxy in relation to the Annual General Meeting (provided that each proxy is appointed to exercise the rights attached to a different share or shares held by them). Such proxy need not be a shareholder of record.

WE ENCOURAGE YOU TO VOTE YOUR SHARES BY SUBMITTING A PROXY AS SOON AS POSSIBLE. IF YOU PLAN TO SUBMIT A PROXY, YOU MUST SUBMIT YOUR PROXY BY INTERNET NO LATER THAN 11:59 P.M. EST ON JUNE 7, 2022 (4:59 A.M. BST ON JUNE 8, 2022) OR, IF YOU ARE VOTING BY MAIL, YOUR PRINTED PROXY CARD MUST BE RECEIVED AT THE ADDRESS STATED ON THE CARD BY JUNE 7, 2022.

| 2022 Proxy Statement |

ANNUAL GENERAL MEETING INFORMATION

| RECORD DATE |

Only Luxfer shareholders of record at the close of business, Eastern Standard Time, on April 14, 2022, the voting notice record date (the “Voting Record Date”) for the Annual General Meeting, are entitled to receive notice of and vote at the Annual General Meeting. Changes to entries on the register after the Voting Record Date will be disregarded in determining the rights of any person to attend or vote at the Annual General Meeting. If you are the beneficial owner of Luxfer ordinary shares (i.e., hold your Luxfer ordinary shares in “street name”) as of April 14, 2022, you will have the right to direct your broker, bank, trust, or other nominee on how to vote such Luxfer ordinary shares at the Annual General Meeting.

| HOW TO VOTE |

We encourage you to cast your vote by one of the following methods:

|  |  |

VOTE BY INTERNET www.envisionreports.com/LXFR | VOTE BY PHONE 1-600-652-VOTE (8683) *Available to U.S. and Canadian holders only | VOTE BY MAIL See Proxy Card |

If your Luxfer ordinary shares are held in “street name” by your broker, bank, trust, or other nominee, only that holder can vote your Luxfer ordinary shares, and the vote cannot be cast unless you provide instructions to your broker, bank, trust, or other nominee or obtain a legal proxy from your broker, bank, trust, or other nominee. You should follow the directions provided by your broker, bank, trust, or other nominee regarding how to instruct such person to vote your Luxfer ordinary shares.

Please note that holders of Luxfer ordinary shares through a broker, bank, trust, or other nominee may be required to submit voting instructions to their applicable broker or nominee at or prior to the deadline applicable for the submission by registered holders of Luxfer ordinary shares. Such holders should, therefore, follow the separate instructions that will be provided by their broker, bank, trust, or other nominee.

YOUR VOTE IS IMPORTANT. Even if you plan to attend the Annual General Meeting, please submit a proxy card or voting instruction form for the Annual General Meeting as soon as possible. For specific instructions on voting, please review this Proxy Statement or the proxy card included with the proxy materials.

| ONLINE AVAILABILITY OF PROXY MATERIALS |

The Company is furnishing proxy materials to some of our shareholders electronically by mailing a Shareholder Meeting Notice instead of mailing or e-mailing copies of those materials. The Shareholder Meeting Notice directs shareholders to the following website where they may access our proxy materials and view instructions on how to vote via the internet, mobile device, or by telephone: www.envisionreports.com/LXFR. If you received a Shareholder Meeting Notice and would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Shareholder Meeting Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive access to those materials electronically unless you elect otherwise. Limited copies of proxy materials will be provided free of charge at the Annual General Meeting.

Copies of our Annual Report on Form 10-K (without exhibits) for the year ended December 31, 2021 filed with the SEC on February 25, 2022, and any other documents incorporated by reference in this proxy statement (the “Proxy Statement”) will also be made available on our website at https://www.luxfer.com/investors/reports-and-presentations/ prior to the Annual General Meeting. The Company’s U.K. Annual Report and Accounts for the year ended December 31, 2021, which consist of the U.K. statutory accounts, the Directors’ Report, the Directors’ Remuneration Report, the Strategic Report, and the Auditor’s Report (collectively, the “U.K. Annual Report and Accounts”) will also be made available on the Luxfer website. There will be an opportunity at the Annual General Meeting for shareholders to review, ask questions, or make comments on all proxy materials. Please refer to the section entitled “Where You Can Find More Information” on page 8485 of the Proxy Statement for more information.

|

ANNUAL GENERAL MEETING INFORMATION

| INFORMATION AND CONCERNS RELATED TO COVID-19 |

Although we plan to hold the Annual General Meeting in person, considering the ongoing public health concerns surrounding the COVID-19 pandemic, we may deem it necessary to hold the Annual General Meeting solely by means of remote communication (i.e., a virtual-only meeting) or as a hybrid meeting (i.e., permitting both virtual and limited in-person attendance). In the event of such necessity, we will announce the decision in a press release and will file additional proxy soliciting material with the SEC. The details will also be posted on our website at https://www.luxfer.com/. While the health and wellbeing of our stakeholders is our priority, we are also committed to ensuring that shareholders can exercise their right to vote. Due to the potential risks of attending the Annual General Meeting in person and restrictions on travel and public gatherings, we encourage our shareholders to vote by internet, phone, or mail.

| 2022 Proxy Statement |

QUESTIONS AND ANSWERS ABOUT THE

ANNUAL GENERAL MEETING

This Proxy Statement relates to the solicitation of proxies by the Board of Directors of Luxfer Holdings PLC (“Luxfer” or the “Company”) to be used at the Annual General Meeting of Shareholders and any adjournments thereof. The meeting will be held at the Luxfer MEL Technologies site, which is located at Lumns Lane, Manchester, M27 8LN, United Kingdom, on June 8, 2022, at 2:00 p.m. BST.

The following are questions that Luxfer shareholders may have regarding the proposals being considered at the Annual General Meeting and brief answers to those questions. Luxfer urges you to carefully read this entire Proxy Statement and the appendices, as the information in this section does not provide all information that may be important to you.

| Q: | Who can vote at the Luxfer Annual General Meeting? |

| A: | The Board has set the close of business, Eastern Standard Time, on April 14, 2022, as the Voting Record Date for the Annual General Meeting. At the close of business on the Voting Record Date, we had |

Each ordinary share is entitled to one vote on each matter that is properly brought before the Annual General Meeting.

| Q: | What is a proxy statement and what is a proxy? |

| A: | A proxy statement is a document that U.S. Securities and Exchange Commission (“SEC”) regulations require us to provide when we ask you to sign a proxy designating individuals to vote on your behalf. A proxy is your legal designation of another person (a “proxy”) to vote on your behalf. By voting your proxy, you are giving the persons named on the proxy card the authority to vote your shares in the manner you indicate on your proxy card. You may vote your proxy over the internet, by phone, or by signing and dating the proxy card and submitting it by mail. |

| Q: | Upon what am I being asked to vote at the Annual General Meeting? |

| A: | You are being asked to consider and vote upon the following ordinary resolutions: |

| 1. | To elect Andy Butcher as a Director of the Company. |

| 2. | To elect Patrick Mullen as a Director of the Company. |

| 3. | To re-elect Clive Snowdon as a Director of the Company. |

| 4. | To re-elect Richard Hipple as a Director of the Company. |

| 5. | To re-elect Lisa Trimberger as a Director of the Company. |

| 6. | To approve, by non-binding advisory vote, the Directors’ Remuneration Report for the year ended December 31, 2021. |

| 7. | To approve, by non-binding advisory vote, the compensation of Luxfer’s Named Executive Officers. |

| 8. | To approve, by non-binding advisory vote, the frequency of “Say-On-Pay” votes. |

| 9. | To ratify the re-appointment of PricewaterhouseCoopers LLP as the Independent Auditor of Luxfer Holdings PLC until conclusion of the 2023 Annual General Meeting. |

| 10. | To authorize the Audit Committee of the Board of Directors to set the Independent Auditor’s remuneration. |

| 11. | To approve the Company’s Amended and Restated Long-Term Umbrella Incentive Plan. |

| 12. | To approve the Company’s Amended and Restated Non-Executive Directors Equity Incentive Plan. |

|

QUESTIONS & ANSWERS ABOUT THE ANNUAL GENERAL MEETING

You are also being asked to consider and vote upon the following special resolutions:

| 13. | Subject to (i) the consent of the holders of the deferred shares of £0.0001 each in the capital of the Company (the “Deferred Shares”) being duly obtained in accordance with Article 7 of the Company’s Articles of Association and (ii) the confirmation of the court, to approve the reduction of the issued share capital of the Company by cancelling and extinguishing all of the issued Deferred Shares, each of which is fully paid up, and, of the amount by which the share capital is so reduced, an aggregate sum of £76,180.60 be repaid to the holders of Deferred Shares (pro rata to their holdings of Deferred Shares) and the remaining amount be credited to the Company’s reserves. |

| 14. | Subject to Resolution 13 being duly passed as a special resolution and the capital reduction described therein taking effect, to approve amendment of the Company’s Articles of Association by deleting Article 5.2 and the definition of “Deferred Shares” set forth in Article 2.1. |

| Q: | What is the recommendation of Luxfer’s Board of Directors? |

| A: | The Board of Directors unanimously recommends that you vote “for” Resolutions 1 - 7 and 9 - 14, and “every 1 year” for Resolution 8. |

| Q: | What is the difference between a shareholder of record and a beneficial owner? |

| A: | If your shares are registered directly in your name with Computershare Trust Company, N.A. (“Computershare”), you are a “shareholder of record.” If your shares are held in a stock brokerage account or by a bank or other custodian, you are considered the “beneficial owner” of shares held in “street name”. As a beneficial owner, you have the right to direct your broker, bank, or other custodian on how to vote your shares. |

| Q: | How do I vote my shares? |

| A: | Your vote is important. We encourage you to vote promptly, which may save us the expense of a second mailing. If you are a holder of record, you may vote your shares in any of the following ways: |

| · | By Internet: You may vote your shares via the website www.envisionreports.com/LXFR. You may vote via the internet 24 hours a day through 11:59 p.m. EST on June 7, 2022 (4:59 a.m. BST on June 8, 2022). You may confirm that the system has properly recorded your vote. If you vote via the internet, you do not need to mail a proxy card. You may incur costs, such as internet access charges, if you vote online. |

| · | By Phone: Holders within the U.S., U.S. territories, and Canada may vote their shares toll free by calling 1-800-652-VOTE (8683). |

| · | By Mail: You may vote your shares by marking, dating, and signing your proxy card and returning it by mail in the enclosed postage-paid envelope. |

| · | In person at the Annual General Meeting: If you are a registered shareholder and choose not to vote via the internet, phone, or by mail, you may still attend the meeting and vote in person. If you vote prior to the meeting, you may still attend the meeting and vote in person. |

If you are a beneficial holder, the instructions that accompany your proxy materials will indicate how you may vote. If you wish to attend the meeting and vote in person, you must bring a legal proxy from the organization that holds your Luxfer ordinary shares or a brokerage statement showing ownership of Luxfer ordinary shares as of the close of business, Eastern Standard Time, on the Voting Record Date.

| Q: | What is the deadline to vote my shares if I do not vote in person at the Annual General Meeting? |

| A: | If you are a shareholder of record, you may vote by internet or phone until 11:59 p.m. EST on June 7, 2022 (4:59 a.m. BST on June 8, 2022) or, if you are a shareholder of record and submit a proxy card by mail, the proxy card must be received at the address stated on the proxy card by June 7, 2022. If you are a beneficial owner, please follow the voting instructions provided by your bank, broker, or other custodian. |

| 2022 Proxy Statement |

QUESTIONS & ANSWERS ABOUT THE ANNUAL GENERAL MEETING

| Q: | How do I attend the Annual General Meeting? |

| A: | All shareholders of record, whether registered or beneficial, as of the close of business, Eastern Standard Time, on the Voting Record Date are invited to attend the Annual General Meeting. Representatives of institutional shareholders must bring a legal proxy or other proof that they are representatives of an institution that held shares as of the close of business, Eastern Standard Time, on the Voting Record Date and are authorized to vote on behalf of such institution. |

| Q: | May I change or revoke my proxy? |

| A: | If you are a shareholder of record and have already voted, you may change or revoke your proxy before it is exercised at the Annual General Meeting in the following ways: |

| ▪ | By voting via internet or phone at a later date than your previous vote but prior to the voting deadline of 11:59 p.m. EST on June 7, 2022 (4:59 a.m. BST on June 8, 2022); |

| ▪ | By mailing a proxy card that is properly signed and dated later than your previous vote and that is received by June 7, 2022; or |

| ▪ | By attending the Annual General Meeting and voting in person. |

If you are a beneficial owner, you must contact the record holder of your shares to revoke a previously authorized proxy or voting instructions.

| Q: | If my Luxfer ordinary shares are held in “street name” by my broker, bank, or other custodian, will my broker, bank, or other custodian vote my shares for me? |

| A: | Yes. If your Luxfer ordinary shares are held in “street name” by your broker, bank, or other custodian, only that holder can vote your Luxfer ordinary shares, and the vote cannot be cast unless you provide instructions to your broker, bank, or other custodian or obtain a legal proxy from your broker, bank, or other custodian. Please follow the directions provided by your broker, bank, or other custodian regarding how to instruct such person to vote your Luxfer ordinary shares. |

| Q: | What is the effect of broker non-votes and abstentions? |

| A: | A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular agenda item because the broker does not have discretionary voting power for that item and has not received instructions from the beneficial owner. Although brokers have discretionary power to vote your shares with respect to “routine” matters, they do not have discretionary power to vote your shares on “non-routine” matters pursuant to NYSE rules. If you do not provide voting instructions for matters considered “non-routine,” a broker non-vote occurs. If a broker does not receive voting instructions from you regarding non-routine matters, the broker non-vote will have no effect on the vote on such agenda items. For example, the ratification of the selection of the independent auditor is considered a routine matter, and your broker can vote for or against this resolution at its discretion, but the election of Directors is not considered routine for these purposes. |

| Q: | How will my shares be voted if I do not specify how they should be voted? |

| A: | If you submit a proxy to Luxfer-designated proxy holders and do not provide specific voting instructions, you instruct Luxfer-designated proxy holders to vote your shares in accordance with the recommendations of the Board of Directors. |

| Q: | How will voting on any other business be conducted? |

| A: | Other than matters incidental to the conduct of the Annual General Meeting and those set forth in this Proxy Statement, we do not know of any business or proposals to be considered at the Annual General Meeting. If any other business is proposed and properly presented at the Annual General Meeting, you instruct Luxfer-designated proxy holders, in the absence of other specific instructions or the appointment of other proxy holders, to vote your shares in accordance with the recommendations of the Board of Directors. |

|

QUESTIONS & ANSWERS ABOUT THE ANNUAL GENERAL MEETING

| Q: | What constitutes a quorum for the Annual General Meeting? |

| A: | A quorum is necessary to hold a valid meeting of shareholders. Our Articles of Association require a quorum of two members present in person or by proxy and entitled to vote in order to transact business at a general meeting. A shareholder that is a company is to be considered present if it is represented by a duly authorized representative. |

Your shares will be counted towards the quorum if you submit a proxy or vote at the Annual General Meeting. If there is not a quorum, the Annual General Meeting shall be adjourned to another day (being not less than 10 days later, excluding the day on which the meeting is adjourned and the day for which it is reconvened) and at such other time or place as the Chair of the meeting may decide.

| Q: | What happens if the Annual General Meeting is adjourned or postponed? |

| A: | Your proxy will still be effective and will be voted at the rescheduled Annual General Meeting. You will still be able to change or revoke your proxy until it is voted. |

| Q: | How can I find the results of the Annual General Meeting? |

| A: | Preliminary results will be announced at the Annual General Meeting. Results will also be published in a current report on Form 8-K to be filed with the SEC within four business days after the meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available. |

| Q: | Why did I receive more than one set of proxy materials or multiple proxy cards? |

| A: | You may have received multiple sets of proxy materials if you hold your shares in different ways or accounts (for example, 401(k) accounts, joint tenancy, trusts, custodial accounts) or in multiple accounts. If you are the beneficial owner of shares held in “street name,” you will receive your voting information from your bank, broker, or other custodian, and you will vote as indicated in the materials you receive from your bank, broker, or other custodian. Please vote your proxy for each separate account you have. |

| Q: | Why did my household receive only one copy of the proxy materials? |

| A: | We take advantage of the SEC’s “householding” rules to reduce the delivery cost of materials. Under such rules, only one set of proxy materials is delivered to multiple shareholders sharing an address unless we have received contrary instructions from one or more of the shareholders. If you are a shareholder sharing an address and wish to receive a separate copy of the proxy materials, you may so request by contacting Computershare by phone at 1-866-641-4276 or by email at investorvote@computershare.com (please include “Proxy Materials Luxfer Holdings PLC” in the subject line and include your full name and address). A separate copy will promptly be provided following receipt of your request, and you will receive separate materials in the future. If you currently share an address with another shareholder but are nonetheless receiving separate copies of the materials, you may request delivery of a single copy in the future by contacting Computershare at the phone number or email address shown above. |

| 2022 Proxy Statement |

This summary includes information contained elsewhere in this Proxy Statement. We urge you to carefully read the remainder of this Proxy Statement, including the attached appendices, as this summary does not provide all the information that may be important to you with respect to matters being considered at the Annual General Meeting. See also the section entitled “Where You Can Find More Information” on page 84.85.

The Annual General Meeting of Luxfer shareholders will be held at the Luxfer MEL Technologies site, located at Lumns Lane, Manchester, M27 8LN, United Kingdom (with entrance on Rake Lane), on Wednesday, June 8, 2022, at 2:00 p.m. BST.

| Ordinary Resolutions: | Our Board of Directors Recommends You Vote: | ||

| 1. | To elect Andy Butcher a Director of the Company. |  | FOR |

| 2. | To elect Patrick Mullen as a Director of the Company. |  | FOR |

| 3. | To re-elect Clive Snowdon as a Director of the Company. |  | FOR |

| 4. | To re-elect Richard Hipple as a Director of the Company. |  | FOR |

| 5. | To re-elect Lisa Trimberger as a Director of the Company. |  | FOR |

| 6. | To approve, by non-binding advisory vote, the Directors’ Remuneration Report for the year ended December 31, 2021 (the “Directors’ Remuneration Report”). |  | FOR |

| 7. | To approve, by non-binding advisory vote, the compensation of the Company’s Named Executive Officers (the “Named Executive Officers”). |  | FOR |

| 8. | To approve, by non-binding advisory vote, the frequency of “Say-On-Pay” votes. |  | EVERY 1 YEAR |

| 9. | To ratify the re-appointment of PricewaterhouseCoopers LLP as the independent auditor (the “Independent Auditor”) of the Company until conclusion of the 2023 Annual General Meeting. |  | FOR |

| 10. | To authorize the Audit Committee of the Board of Directors to set the Independent Auditor’s remuneration. |  | FOR |

| 11. | To approve the Company’s Amended and Restated Long-Term Umbrella Incentive Plan. |  | FOR |

| 12. | To approve the Company’s Amended and Restated Non-Executive Directors Equity Incentive Plan. |  | FOR |

| Special Resolutions | |||

| 13. | Subject to (i) the consent of the holders of the deferred shares of £0.0001 each in the capital of the Company (the “Deferred Shares”) being duly obtained in accordance with Article 7 of the Company’s Articles of Association and (ii) the confirmation of the court, to approve the reduction of the issued share capital of the Company by cancelling and extinguishing all of the issued Deferred Shares, each of which is fully paid up, and that, of the amount by which the share capital is so reduced, an aggregate sum of £76,180.60 be repaid to the holders of Deferred Shares (pro rata to their holdings of Deferred Shares) and the remaining amount be credited to the Company’s reserves. |  | FOR |

| 14. | Subject to Resolution 13 being duly passed as a special resolution and the capital reduction described therein taking effect, to approve amendment of the Company’s Articles of Association by deleting Article 5.2 and the definition of “Deferred Shares” set forth in Article 2.1. |  | FOR |

Only Luxfer shareholders of record at the close of business, Eastern Standard Time, on April 14, 2022 (the “Voting Record Date”) are eligible to receive notice of and vote at the AGM. If you are the beneficial owner of Luxfer ordinary shares (i.e., you hold Luxfer ordinary shares in “street name”) as of the Voting Record Date, you will have the right to direct your broker, bank, trust, or other nominee on how to vote such shares at the AGM. If you are a shareholder of record or a beneficial owner as of the Voting Record Date, we encourage you to cast your vote as soon as possible in one of the following ways:

|  |  |  |

VOTE BY INTERNET www.envisionreports.com/LXFR | VOTE BY PHONE 1-600-652-VOTE (8683) *Available to U.S. and Canadian holders only | VOTE BY MAIL See Proxy Card | VOTE IN PERSON |

|

PROXY STATEMENT SUMMARY

| 2021 BUSINESS AND PERFORMANCE HIGHLIGHTS |

Fiscal year 2021 was defined by strong end-market demand, supply chain challenges, a highly competitive labor market, and the evolving impacts from COVID-19. Despite this backdrop, we delivered strong business results for the year, including a 15.2% sales increase, 7.5% organic revenue growth, and a 17.6% EBITDA increase.2 Full year cash flow was strong even after making a total of $18.2 million in payments to our U.K. pension to achieve zero pension deficit based on our 2021 tri-annual valuation. Our net debt finished the year at $53.4 million, a slight expansion from the prior year, with a net debt to EBITDA ratio of 0.8 times. On a trailing twelve-month basis, we delivered 17.4% ROIC from adjusted earnings. We also returned approximately $20 million to shareholders through dividends and share buybacks throughout the year. These results demonstrate that 2021 was another solid year of balance sheet strength with operating cash flow generation, improved pension performance and position, and completion of a new five-year revolving credit facility. Despite lingering uncertainties and supply chain constraints related to the pandemic, our strong balance sheet affords us greater flexibility and better positioning to create additional value for our shareholders in 2022.

| OUR BOARD OF DIRECTORS |

| Name | Age | Independent | Director Since | Board Committee Membership |

| Andy Butcher (CEO) | 53 | 2022 | None | |

| Patrick Mullen (Board Chair) | 57 |  | 2021 | Nominating & Governance; Remuneration |

| Clive Snowdon | 69 |  | 2016 | Nominating & Governance (Chair); Audit |

| Richard Hipple | 69 |  | 2018 | Remuneration (Chair); Audit |

| Lisa Trimberger | 61 |  | 2019 | Audit (Chair); Remuneration |

The Company wishes to highlight the following Board transitions:

| · | Alok Maskara, who has served as Chief Executive Officer and a member of Luxfer’s Board since May 2017, has elected to leave the Company in pursuit of another opportunity. With unanimous approval from the Board, Andy Butcher was named Chief Executive Officer and a member of Luxfer’s Board of Directors, effective May 6, 2022. |

| · | Patrick Mullen was appointed as a Non-Executive Director in September 2021. Mr. Mullen was identified as a potential new Director due largely to his executive management and leadership experience and his extensive global industrial and engineering background. As of January 1, 2022, he serves as a member of the Nominating and Governance Committee and the Remuneration Committee. |

| · | David Landless, who was elected to the Board in 2013 and served as Board Chair since 2019, announced his decision not to stand for re-election at the 2022 Annual General Meeting. Mr. Landless’ retirement is in accordance with the Company’s Corporate Governance Guidelines, which advise retirement of Directors after nine years of service. Effective March 11, 2022, the Board appointed Mr. Mullen to succeed Mr. Landless as Board Chair. Mr. Mullen will continue to serve as a member of the Nominating and Governance Committee and the Remuneration Committee. |

| · | Allisha Elliott, who was elected to the Board in 2019, resigned from the Board effective December 31, 2021. Ms. Elliott’s resignation was not the result of any disagreement with management or the Board, but rather, was driven by personal considerations. |

For more information on our Directors, please see “Directors Standing for Election or Re-Election” on page 33.34.

| 2 | Organic revenue growth and EBITDA are non-GAAP measures. For a reconciliation and explanation of these non-GAAP measures, see Appendix A. |

| 2022 Proxy Statement |

PROXY STATEMENT SUMMARY

| CORPORATE GOVERNANCE HIGHLIGHTS |

Luxfer is committed to strong corporate governance practices and policies, which support effective Board leadership and prudent management practices. Key features of our corporate governance practices include the following:

| · | Annual election of all Directors, with majority voting in uncontested Director elections; |

| · | All Director nominees are independent, except for our CEO; |

| · | Independent Board Chair; |

| · | Independent Audit, Nominating and Governance, and Remuneration Committees; |

| · | No Director nominees have disclosable related party transactions or conflicts of interest; |

| · | Robust risk oversight by the full Board, with specific responsibilities delegated to the relevant Board Committees; |

| · | Purposeful inclusion of key risk areas on Board and/or Committee agendas, enabling continuous Board oversight of risk mitigation; |

| · | Engagement with business leaders to discuss short-term and long-term strategic opportunities and associated risks; |

| · | Annual advisory vote on executive compensation; |

| · | Incentive compensation includes design features intended to balance “Pay for Performance” with the appropriate level of risk taking; |

| · | Commitment to Board refreshment and diversity; |

| · | Range of Director tenures and experience facilitate effective oversight and a balance between historical experience and fresh perspectives; |

| · | Annual Board and Committee self-assessments to enable evolution and improvement of Board skill and perspective; |

| · | Annual review of Committee Charters and Corporate Governance Guidelines to ensure alignment with best practices; |

| · | Stock Ownership Guidelines for Directors and Executive Officers to encourage investment in the Company and alignment with shareholder interests; |

| · | Provisions on overboarding for Directors; |

| · | Policies prohibiting hedging, pledging, short sales, and margin accounts in relation to Company securities; and |

| · | Commitment to health, safety, and environmental sustainability. |

For more information on Corporate Governance, please see the section entitled “Corporate Governance” on page 40.41.

| ENVIRONMENT, SOCIAL, AND GOVERNANCE HIGHLIGHTS |

Our inaugural ESG Report published in 2020 established environmental goals which we aim to achieve by 2025. In 2021, the Board focused on our efforts to promote long-term shareholder value through our actions in ESG, including investments in projects that would have the most impact on our carbon footprint. We look forward to providing further details on our progress in an updated ESG Report to be published in late 2022. Key features of our 2021 ESG efforts include:

| · | Board’s oversight of ESG matters, including strategic planning, risks, and opportunities, with regular updates from the CEO and senior management; |

| · | Targeted investments in new projects and technology to reduce our carbon footprint and increase operational efficiencies; |

| · | Implementation of our Company-wide ESG balanced scorecard to collect detailed data and track progress on CO2, waste, water, social, and governance KPIs; |

| · | Biannual ESG scorecard reviews with the CEO, senior management, and environmental, health, and safety team members; |

| · | Carbon Life Cycle Analyses on key products to improve product sustainability; |

| · | New requirements for suppliers and distributors to attest compliance with our Third Party Code of Conduct; |

| · | Increased talent, investment, and resources for IT security; |

| · | Expanded diversity, equity, and inclusion recruitment practices and increased diversity training; |

| · | Demonstrated track record of safety performance; and |

| · | Continued fostering a performance culture with high ethical standards that values integrity, accountability, and innovation, and which is designed to encourage individual growth and operational effectiveness. |

For more information on Luxfer’s ESG efforts, please see the section entitled “Environment, Social, and Human Capital Initiatives” on page 45.46.

|

PROXY STATEMENT SUMMARY

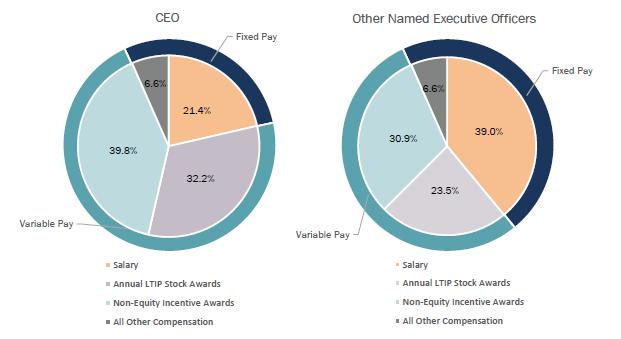

| EXECUTIVE COMPENSATION HIGHLIGHTS |

The Remuneration Committee of Luxfer’s Board of Directors believes that the most effective executive compensation program aligns executive initiatives with shareholders’ economic interests. The Committee seeks to accomplish this alignment by rewarding the achievement of specific annual, long-term, and strategic goals that create lasting shareholder value. Luxfer’s compensation program includes the following compensation elements: (i) base salary; (ii) non-equity incentive compensation; (iii) long-term equity incentive awards; (iv) pension or 401(k) contributions; (v) employee share purchase plans; and (vi) other benefits, such as flex-perks and healthcare, life, and disability insurance coverage.

| 2021 NAMED EXECUTIVE OFFICERS’ COMPENSATION STRUCTURE |

Luxfer continued to emphasize “Pay for Performance” in 2021, specifically through non-equity incentive compensation for most employees and equity awards pursuant to the Long-Term Umbrella Incentive Plan (“LTIP”) for executives and senior management. The LTIP ensures alignment between Luxfer’s management team and our shareholders, as the majority of LTIP awards are based upon the achievement of specific targets involving (i) earnings per share and (ii) relative total shareholder return, as measured against a group of the Company’s peers. In addition to LTIP awards, non-equity incentive compensation also incentivizes business performance, as they are based upon the income and cash conversion of each Executive’s business unit or Luxfer’s overall performance, as applicable, and, with respect to Executives Officers other than the CEO and CFO, the Executive Officer’s individual balanced scorecard objectives. Given the Company’s strong financial performance in 2021, the non-equity incentive compensation awarded in 2021 was higher than that in previous years, as most business units exceeded their Budget Management EBITA and Cash Conversion targets. Additionally, the equity awards granted to Executive Officers under the LTIP for fiscal 2021 performance are expected to be substantial, as the Company achieved a 25.2% adjusted earnings per share increase, exceeding the Maximum target for the year. The measurement period for the total shareholder return metric remains ongoing.3

These Executive Compensation Highlights should be read in connection with the Executive Compensation information included in this Proxy Statement, including the sections entitled “Executive Compensation Discussion and Analysis” and “Executive Compensation Tables” (see pages 5657 through 76)77).

| 3 | Management EBITA and Cash Conversion are non-GAAP measures. For a reconciliation and explanation of these non-GAAP measures, see Appendix A. |

| 2022 Proxy Statement |

RESOLUTIONS 1 - 5: ELECTION OF

DIRECTORS

On the recommendation of the Nominating and Governance Committee, the Board of Directors has nominated the Directors listed below for election or re-election for a one-year term expiring on the completion of the 2023 Annual General Meeting. Management has no reason to believe that any Directors named below would be unable to serve their full term if elected.

Biographies of the Director nominees are included in the section entitled “Biographical Information” on page 3435. These biographies include, for each Director, their age; business experience; the publicly held and other organizations of which they are or have been Directors within the past five years; and a discussion of the specific experience, qualifications, attributes, or skills that led to the conclusion that each should serve as a Director.

Resolutions 1 - 5 are ordinary resolutions. The text of Resolutions 1 - 5 are as follows:

| 1. | To elect Andy Butcher as a Director of the Company. |

| 2. | To elect Patrick Mullen as a Director of the Company. |

| 3. | To re-elect Clive Snowdon as a Director of the Company. |

| 4. | To re-elect Richard Hipple as a Director of the Company. |

| 5. | To re-elect Lisa Trimberger as a Director of the Company. |

Under our Articles of Association, the election or re-election of each Director requires the affirmative vote of a majority of the votes cast in person or by proxy at the Annual General Meeting. A nominee who does not receive a majority of the votes cast on the relevant resolution will not be elected to our Board. Your proxies cannot be voted for a greater number of persons than the number of Directors named in this Proxy Statement.

| The Board of Directors recommends a vote “FOR” each Director nominee. |

|

ORDINARY RESOLUTIONS

RESOLUTION 6: DIRECTORS’

REMUNERATION REPORT

In accordance with Sections 439 and 440 of the Companies Act 2006, our shareholders have the opportunity to cast an advisory vote to approve the Directors’ Remuneration Report.

Resolution 6 is an ordinary resolution. The text of Resolution 6 is as follows:

| 6. | To approve, by non-binding advisory vote, the Directors’ Remuneration Report. |

As Resolution 6 is an advisory vote, the result of the vote is advisory only and will not be legally binding on the Board of Directors or any committee thereof to take any action or refrain from taking any action. However, our Board values the opinions of our shareholders as expressed through advisory votes and other communications and will carefully consider the outcome of the advisory vote.

| The Board of Directors and Remuneration Committee recommend a vote “FOR” the approval of the Directors’ Remuneration Report for the year ended December 31, 2021. |

| 2022 Proxy Statement |

ORDINARY RESOLUTIONS

RESOLUTION 7: EXECUTIVE

COMPENSATION

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 and the related rules of the SEC, our shareholders have the opportunity to cast an advisory vote to approve the compensation of our Named Executive Officers disclosed in the sections of this Proxy Statement entitled “Executive Compensation Discussion and Analysis” and “Executive Compensation Tables” on pages 5657 through 76.77.

Executive compensation is an important matter to the Board of Directors, the Remuneration Committee, and our shareholders. We have designed our executive compensation program to align executive and shareholder interests by rewarding the achievement of specific annual, long-term, and strategic goals that create long-term shareholder value. We believe that our executive compensation program (i) provides competitive compensation that will motivate and reward executives for achieving financial and strategic objectives; (ii) provides rewards commensurate with performance to incentivize the Named Executive Officers to perform at their highest levels; (iii) encourages growth and innovation; (iv) attracts and retains the Named Executive Officers and other key executives; and (v) aligns our executive compensation with shareholders’ interests through the use of long-term equity incentive awards.

The Remuneration Committee has overseen the development and implementation of our executive compensation program in line with the foregoing compensation objectives. The Remuneration Committee also continuously reviews, evaluates, and updates our executive compensation program to ensure that we provide competitive compensation that motivates the Named Executive Officers and other key executives to perform at their highest levels, while increasing long-term value to our shareholders.

Resolution 7 is an ordinary resolution. The text of Resolution 7 is as follows:

| 7. | To approve, by non-binding advisory vote, the compensation of the Company’s Named Executive Officers. |

As Resolution 7 is an advisory vote, the result of the vote is advisory only and will not be legally binding on the Board of Directors or any committee thereof to take any action or refrain from taking any action. However, our Board values the opinions of our shareholders as expressed through advisory votes and other communications and will carefully consider the outcome of the advisory vote.

| The Board of Directors and Remuneration Committee recommend a vote “FOR” the approval of the compensation of the Named Executive Officers. |

|

ORDINARY RESOLUTIONS

RESOLUTION 8: “SAY-ON-PAY” VOTES

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 and the related rules of the SEC, our shareholders have the opportunity to cast an advisory vote to approve the compensation of our Named Executive Officers. Resolution 8 affords shareholders the opportunity to cast an advisory vote on how often we should include a Say-On-Pay proposal in our proxy materials for future annual shareholder meetings or any special shareholder meeting for which we must include executive compensation information in that meeting’s proxy statement (a “Say-On-Pay Vote”). Under this Resolution 8, shareholders may vote to hold the Say-On-Pay Vote every year, every two years, or every three years.

As an advisory vote, this proposal is not binding on Luxfer, the Board of Directors, or the Remuneration Committee. However, the Board of Directors and the Remuneration Committee value the opinions expressed by shareholders in their votes on this proposal and will consider the outcome of the vote when making future decisions regarding the frequency of conducting a Say-On-Pay Vote.

It is expected that the next Say-On-Pay Vote will occur at the 2023 Annual General Meeting.

Resolution 8 is an ordinary resolution. The text of Resolution 8 is as follows:

| 8. | To approve, by non-binding advisory vote, the frequency of “Say-On-Pay” votes. |

As Resolution 8 is an advisory vote, the result of the vote is advisory only and will not be legally binding on the Board of Directors or any committee thereof to take any action or refrain from taking any action. However, our Board values the opinions of our shareholders as expressed through advisory votes and other communications and will carefully consider the outcome of the advisory vote.

| The Board of Directors and Remuneration Committee recommend a vote of “EVERY 1 YEAR” as to the frequency of Say-On-Pay votes on executive compensation. |

| 2022 Proxy Statement |

ORDINARY RESOLUTIONS

RESOLUTION 9: APPOINTMENT OF

INDEPENDENT AUDITOR

The Audit Committee has selected and appointed PricewaterhouseCoopers LLP (“PwC”) to audit the Company’s financial statements for the fiscal year ending December 31, 2022. The Board, upon the recommendation of the Audit Committee, is asking Luxfer shareholders to ratify the re-appointment of PwC as the Independent Auditor of the Company. Although approval is not required by our Articles of Association, the Board of Directors is submitting the re-appointment of PwC to our shareholders because we value our shareholders’ views on our Independent Auditor. If the re-appointment of PwC is not ratified by shareholders, it will be considered a notice to the Board of Directors and the Audit Committee to consider the selection of a different firm. Even if the appointment is ratified, the Audit Committee, in its discretion, may select a different Independent Auditor at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders. In accordance with the Companies Act 2006, any appointment of the Company’s Independent Auditor will continue to be subject to shareholder ratification.

The Audit Committee is directly responsible for the appointment, remuneration, retention, and oversight of the Independent Auditor retained to audit the Company’s financial statements. PwC has been retained as the Company’s Independent Auditor since 2015. In determining whether to re-appoint PwC as the Company’s Independent Auditor, the Audit Committee took into account a number of factors, including PwC’s independence and objectivity; PwC’s capability and expertise in handling our industry, including the expertise and capability of the lead engagement partner; historic and recent performance, including the extent and quality of PwC’s communications with the Audit Committee; the results of management and Audit Committee assessments of PwC’s overall performance; the appropriateness of PwC’s fees, both on an absolute basis and as compared with its peers; and the length of time that PwC has been engaged. Consistent with regular rotation requirements, a new lead engagement partner was appointed to lead PwC's audit of Luxfer's financial statements in 2020. The members of the Audit Committee and the Board of Directors believe that the continued retention of PwC as the Company’s Independent Auditor is in the best interests of the Company and our shareholders.

We expect that a representative of PwC will be present at the Annual General Meeting and will have the opportunity to make a statement, if he or she desires, as well as be available to respond to any questions.

Resolution 9 is an ordinary resolution. The text of Resolution 9 is as follows:

| 9. | To ratify the re-appointment of PricewaterhouseCoopers LLP as the Independent Auditor of the Company until conclusion of the 2023 Annual General Meeting. |

Ratification of the re-appointment of PricewaterhouseCoopers LLP as the Independent Auditor of Luxfer Holdings PLC for the year ending December 31, 2022 requires the affirmative vote of a majority of the votes cast in person or by proxy at the Annual General Meeting.

| The Board of Directors and the Audit Committee recommend a vote “FOR” the ratification of the re-appointment of PricewaterhouseCoopers LLP as the Independent Auditor of the Company for 2022. |

|

ORDINARY RESOLUTIONS

AUDITOR’S REMUNERATION

The Board, upon the recommendation of the Audit Committee, is asking Luxfer’s shareholders to authorize the Audit Committee of the Board of Directors to set the Independent Auditor’s remuneration.

The Audit Committee is directly responsible for the appointment, remuneration, retention, and oversight of the Independent Auditor retained to audit Luxfer's financial statements. The Audit Committee, with the input of management, is responsible for the audit fee negotiations associated with the Company’s retention of PricewaterhouseCoopers LLP. The Audit Committee and the Board of Directors believe that the remuneration level set for our Independent Auditor is in the best interests of the Company and our shareholders.

Resolution 10 is an ordinary resolution. The text of Resolution 10 is as follows:

| 10. | To authorize the Audit Committee of the Board of Directors to set the Independent Auditor’s remuneration. |

Authorization of the Audit Committee to set the Independent Auditor’s remuneration requires the affirmative vote of a majority of the votes cast in person or by proxy at the Annual General Meeting.

| The Board of Directors and the Audit Committee recommend a vote “FOR” the authorization of the Audit Committee to set the Independent Auditor’s remuneration. |

| 2022 Proxy Statement |

ORDINARY RESOLUTIONS

RESOLUTION 11: LONG-TERM UMBRELLA

INCENTIVE PLAN

As an important retention tool and to align the long-term financial interests of the Company’s management with those of our shareholders, at the time of our initial public offering, we adopted the Luxfer Holdings PLC Long-Term Umbrella Incentive Plan (the “LTIP”). By its terms, no further Awards may be granted under the LTIP after October 2, 2022. In addition, only 93,550 ordinary shares remain available for issuance under both the LTIP and the Luxfer Holdings PLC Non-Executive Directors Equity Incentive Plan (the “Director EIP”). Given that continuation of long-term equity incentive compensation is essential in attracting, retaining, and motivating highly-qualified employees and executives, the Remuneration Committee and the Board believe that it would be in the best interest of our shareholders to approve an amendment and restatement of the LTIP to (i) extend its term; (ii) provide a fixed pool of ordinary shares available for grant; and (iii) update certain provisions to reflect changes in law and best practices since its adoption. In accordance with the NYSE Listed Company Manual, which requires a company whose shares are listed on the New York Stock Exchange to submit equity compensation plans (and any material revisions thereto) to a shareholder vote, the Board submits this Resolution 11 to shareholders to approve an amendment and restatement of the Luxfer Holdings PLC Long-Term Umbrella Incentive Plan (the “Amended and Restated LTIP”).

The material changes proposed in the Amended and Restated LTIP include:

· | Extending the term of the LTIP to June 8, 2032; |

· | Providing for 1,400,000 Shares to be available for grant under the Amended and Restated LTIP on or after June 8, 2022, and decoupling the combined pool of Shares available for issuance under the LTIP and Director EIP; |

· | Limiting the circumstances under which Shares underlying previously issued Awards may become available for reissuance; |

· | Including a minimum vesting requirement of at least one year for all Awards, except that up to 5% of the Shares reserved under the Amended and Restated LTIP may be exempted from the minimum vesting period requirement; |

· | Clarifying that the Awards granted under the Amended and Restated LTIP are subject to clawback policies and procedures, as set forth in the Award Agreement and the Directors’ Remuneration Policy; |

· | Limiting the discretion of the Remuneration Committee to accelerate vesting of Awards; |

· | Removing language related to the performance-based compensation exception under Section 162(m) of the Internal Revenue Code, which was eliminated by the Tax Cuts and Jobs Act of 2017; and |

· | Clarifying that the Award Agreement may set forth minimum holding periods, specifically with respect to Performance-Based Awards, which Shares underlying such Awards must be held by the Participant for at least twelve months following the vesting, exercise, or lapse of transfer restrictions in respect of the Award. |

Specifically, the Amended and Restated LTIP includes the following best practices:

· | Prohibition on Repricing. The Amended and Restated LTIP explicitly prohibits repricing of Awards, including any Award granted in substitution for outstanding Awards previously granted if such action would be considered repricing. |

· | Minimum Vesting Period. Awards granted have a minimum vesting period of at least one year, except that up to 5% of the Shares reserved under the Amended and Restated LTIP may be exempted from the minimum vesting period requirement. |

· | Separate Fixed Pool. The aggregate number of Shares available under the Amended and Restated LTIP is fixed and separate from the Shares available under the Amended and Restated Director EIP. The Amended and Restated LTIP does not contain an “evergreen” provision that would automatically increase the number of Shares available for issuance. |

· | No Liberal Share Recycling. The Amended and Restated LTIP provides that any Shares (i) surrendered to pay the exercise price of an Option, (ii) withheld by the Company or tendered by the Participant to satisfy tax withholding obligations with respect to any Award, (iii) covered by a Stock Appreciation Right issued under the Plan that are not issued in connection with settlement in Shares upon exercise, or (iv) purchased by the Company using Option exercise proceeds will not be added back, or recycled, to the Amended and Restated LTIP. |

|

ORDINARY RESOLUTIONS

· | No Dividends or Dividend Equivalents Paid on Unvested Awards. The Amended and Restated LTIP prohibits the payment of dividends or dividend equivalents on Awards until those Awards are earned and vested. |

· | Awards Subject to Clawback and Forfeiture. Awards under the Amended and Restated LTIP are subject to the Company’s clawback policy (as described in more detail in this Proxy Statement and set forth in the Directors’ Remuneration Policy and Award Agreement), as well as any other forfeiture conditions determined by the Remuneration Committee and set forth in the Award Agreement or Plan. |

If the Amended and Restated LTIP is approved by our shareholders, (i) the Amended and Restated LTIP will govern the grant of Awards on or after June 8, 2022; (ii) no Shares that remained available for issuance under the LTIP prior to June 8, 2022 will be issued on or after June 8, 2022; and (iii) no Shares underlying Awards granted prior to June 8, 2022 will be or become available for grants of Awards under the Amended and Restated LTIP on or after June 8, 2022. However, all outstanding Awards granted under the LTIP prior to June 8, 2022 will remain outstanding in accordance with their terms.

If shareholders do not approve the Amended and Restated LTIP, the LTIP will remain in effect through October 2, 2022, in accordance with its terms. As the LTIP has a ten year term, the Company would be unable to issue annual equity awards to its employees and executives in the coming years. In this event, the Remuneration Committee would be required to revise its compensation philosophy and devise other programs to attract, retain, and compensate employees and executives.

| SUMMARY OF THE AMENDED AND RESTATED LTIP |

The following is a summary of the key terms of the Amended and Restated LTIP. A copy of the Amended and Restated LTIP, which shows the proposed revisions by way of comparison against the LTIP, is attached hereto as Appendix B and incorporated herein. The information regarding the Amended and Restated LTIP set forth in this Proxy Statement is qualified in its entirety by reference to the full and complete text of the Amended and Restated LTIP. Any inconsistences between the information set forth herein and the text of the Amended and Restated LTIP shall be governed by the text of the Amended and Restated LTIP.

Purpose

The purpose of the Amended and Restated LTIP is to (i) attract and retain high-quality employees in an environment where compensation levels are based on global market practice; (ii) align rewards of employees with returns to shareholders; and (iii) reward the achievement of business targets and key strategic objectives. The Amended and Restated LTIP is designed to serve these goals by providing such employees with a proprietary interest in pursuing the Company’s long-term growth, profitability, and financial success.

Term

Unless the Amended and Restated LTIP is earlier terminated by the Board, Awards may be granted under the Amended and Restated LTIP until June 8, 2032.

Types of Awards

The equity or equity-related awards under the Amended and Restated LTIP are based on our ordinary shares (“Shares”). The Amended and Restated LTIP allows for the grant of (i) stock options to acquire our Shares (“Options”); (ii) stock appreciation rights (“SARs”); (iii) restricted stock (“Restricted Stock Awards”); (iv) restricted stock units (“RSUs”); (v) equity-based or equity-related awards, other than Options, SARs, Restricted Stock Awards, or RSUs (“Other Stock-Based Awards”); and (vi) cash incentive awards (“Cash Incentive Awards”) (collectively referred to as “Awards”).

Administration

Our Remuneration Committee (or other committee as the Board may appoint) (the “Committee”) will administer the Amended and Restated LTIP. Consistent with the terms of the Amended and Restated LTIP, the administrator will have the power to determine to whom the Awards will be granted; determine the amount, type, and other terms of Awards; interpret the terms and provisions of the Amended and Restated LTIP and Award Agreements; accelerate the exercise, vesting, or transfer of the Awards in the event of death or Disability or in the event that the Committee determines the conditions to such vesting, exercisability, or transferability are impractical or unachievable; extend the term of the Awards; provide for the crediting of dividends or dividend equivalents with respect to any Award; delegate certain duties under the Amended and Restated LTIP; and execute certain other actions authorized under the Amended and Restated LTIP.

| 2022 Proxy Statement |

ORDINARY RESOLUTIONS

Eligibility

Any employee of the Company or any of its subsidiaries is eligible for selection by Committee to receive an Award under the Amended and Restated LTIP (such a person who is selected to receive an Award is referred to herein as a “Participant”). As of December 31, 2021, the Company and its subsidiaries had approximately 1,300 employees worldwide.

Available Shares

The maximum aggregate number of Shares that may be issued pursuant to the Awards under the Amended and Restated LTIP on or after June 8, 2022 shall not exceed 1,400,000 Shares, subject to adjustments due to recapitalization, reclassification, or other corporate events, as provided in the Amended and Restated LTIP. If any Shares subject to an Award are forfeited, if any Award or any portion of an Award lapses or expires (including the unvested portion of any Award granted subject to performance targets, which fails to achieve its performance targets in full), or if any Award is settled for cash (in whole or in part) in accordance with its terms, the Shares subject to such Award shall, to the extent of such forfeiture, lapse, expiration, or cash settlement, again be available for future grants of Awards under the Amended and Restated LTIP. Notwithstanding anything to the contrary contained herein, the following Shares shall not be added to the Shares authorized for grant and shall not be available for future grants of Awards: (i) Shares tendered by a Participant or withheld by the Company in payment of the exercise price of an Option; (ii) Shares tendered by the Participant or withheld by the Company to satisfy any tax withholding obligation with respect to any Award; (iii) Shares subject to a SAR that are not issued in connection with the settlement of the SAR in Shares upon exercise thereof; and (iv) Shares purchased on the open market with the cash proceeds from the exercise of Options. As of March 31, 2022, the market value of a Share was $16.80, representing the closing price on the NYSE on such day.

Awards

· | Options. We may grant Options to Participants as determined by the Committee. Unless otherwise determined by the Committee, Options may vest based on the basis of continued employment (“Time-Based”) or may be subject to performance conditions as determined by the Committee (“Performance-Based”) or both. The exercise price of each Option granted under the Amended and Restated LTIP may not be less than the fair market value of Shares as of the date of grant with respect to any Option granted to a Participant that is a U.S. taxpayer. Options may not be exercised later than ten years from the date of grant. The Committee will determine the methods and form of payment for the exercise price of an Option (including, in the discretion of the Committee, net physical settlement or other method of cashless exercise). Unless otherwise determined by the Committee, Options will vest and become exercisable with respect to one-fourth of the Shares subject to the Award on each of the first four anniversaries from the date of grant, provided the Participant is continuously employed by us through each respective anniversary. Upon the termination of the Participant’s employment for any reason other than for Cause (as defined in the Amended and Restated LTIP), all unvested Shares subject to a Time-Based Option will lapse as of the termination date, and any Performance-Based Option will vest pro rata based on the elapsed portion of the applicable performance period and our actual performance as of the date of termination. Except as otherwise provided in the Amended and Restated LTIP or in the applicable Award Agreement, the portion of any Option that is or becomes vested or exercisable as of the date of termination will lapse on the first anniversary of the date of termination of employment to the extent not theretofore. If the Participant’s employment is terminated for Cause, all Shares subject to an Option will lapse as of the termination. |

· | SARs. A SAR is the right to an amount equal to the excess of the fair market value of Shares on the date of exercise over the exercise price of Shares subject to the SAR, settled in cash or Shares, as determined by the Committee at the date of grant. The Committee may grant Time-Based SARs and Performance-Based SARs. The exercise price of Shares subject to the SAR may not be less than the fair market value of Shares on the date of grant with respect to any SAR granted to a Participant that is a U.S. taxpayer. Unless otherwise determined by the Committee, SARs will vest and become exercisable with respect to one-fourth of the Shares subject to the Award on each of the first four anniversaries from the date of grant, provided the Participant is continuously employed by us through each respective anniversary. Upon the termination of the Participant’s employment for any reason other than for Cause, all unvested Shares subject to a Time-Based SAR will lapse as of the termination date, and any Performance-Based SAR will vest pro rata based on the elapsed portion of the applicable performance period and our actual performance as of the date of termination. Except as otherwise provided in the Amended and Restated LTIP or in the applicable Award Agreement, the portion of any SAR that is or becomes vested or exercisable as of the date of termination will lapse on the first anniversary of the date of termination of employment to the extent not theretofore. If the Participant’s employment is terminated for Cause, all Shares subject to a SAR will lapse as of the termination. |

· | Restricted Stock Awards. A Restricted Stock Award is a grant of Shares subject to vesting conditions, restrictions on transferability, and any other restrictions set forth in the Award Agreement. Except as otherwise determined by the Committee, the holder of a Restricted Stock Award will have the right to vote the Shares subject to the Restricted Stock Award during the vesting period. The Committee may grant Time-Based Restricted Stock Awards or Performance-Based Restricted Stock Awards. Unless otherwise determined by the Committee, Time-Based Restricted Stock Awards will vest and become exercisable with respect to one-fourth of the Shares subject to the Award on each of the first four |

|

ORDINARY RESOLUTIONS

| anniversaries from the date of grant, provided the Participant is continuously employed by us through each respective anniversary. If the Participant’s employment with us is terminated for any reason, the unvested Time-Based Restricted Stock Awards will be forfeited as of the termination date. With respect to Performance-Based Restricted Stock Awards, upon a termination of a Participant’s employment for any reason other than for Cause, the Award will vest pro rata based on the elapsed portion of the applicable performance period and our actual performance as of the date of termination. If the Participant’s employment with us is terminated for Cause, the Performance-Based Restricted Stock Awards will be forfeited. |